Our income and expenses

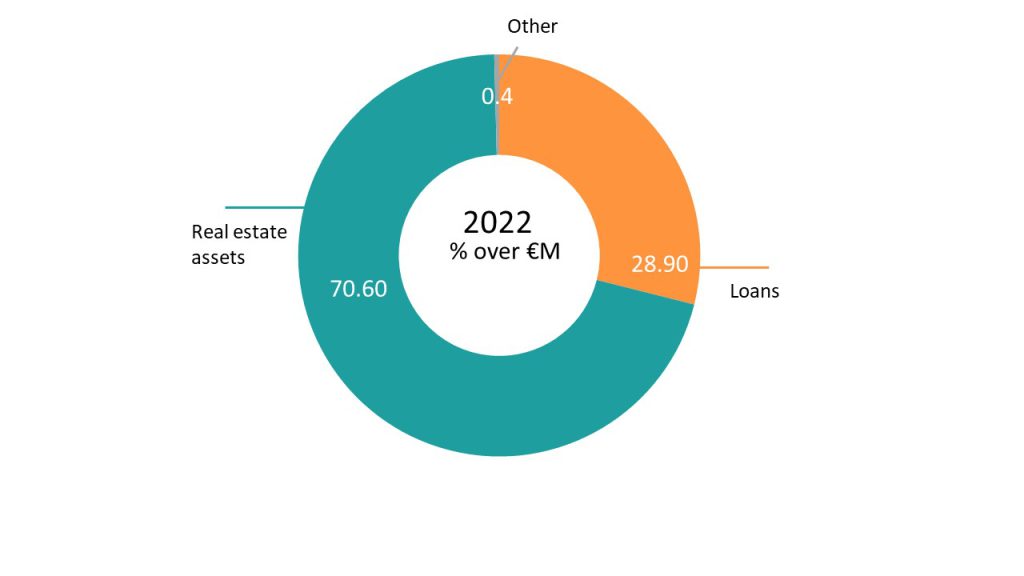

Our income is from the management and sale of two types of assets in our portfolio: developer loans and real estate. Our expenses are financial, commercial, property maintenance, arising from the transformation of assets and those required to maintain our business structure.

Below is a breakdown of our income and expenses taken from our most recent Annual Activity Report.

Sareb’s income

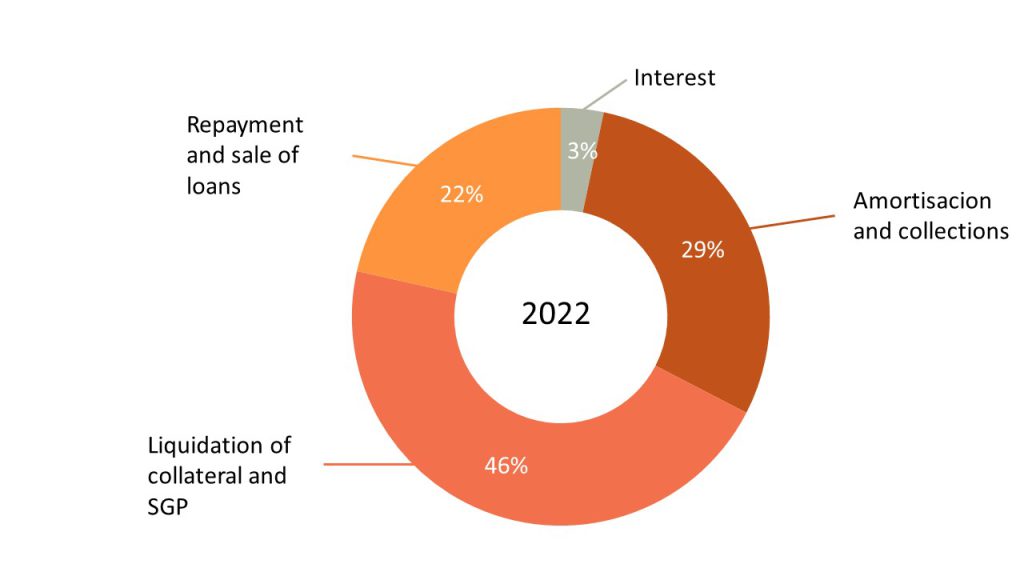

Sareb’s income from the management of loans

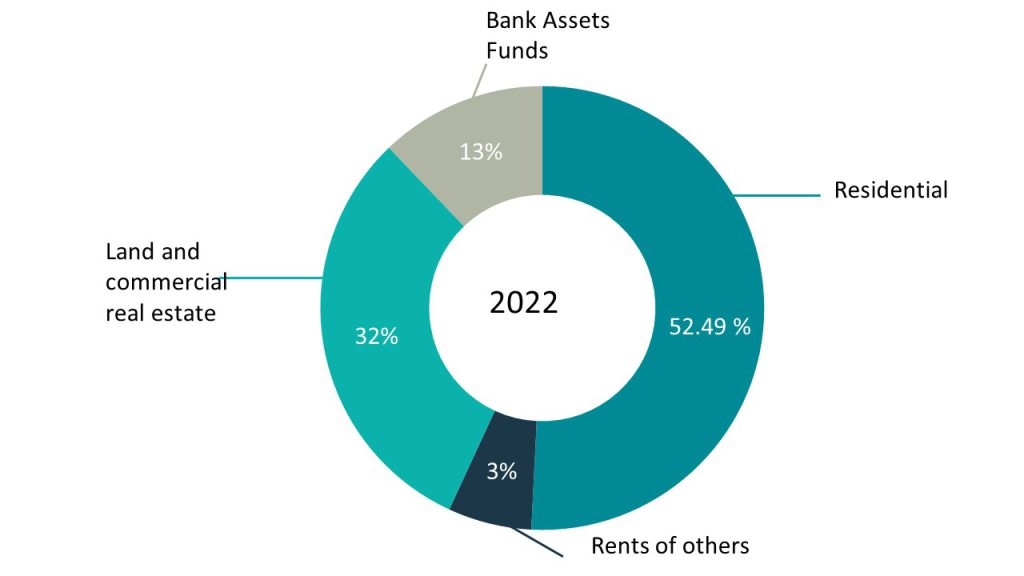

Sareb’s income from the management of properties

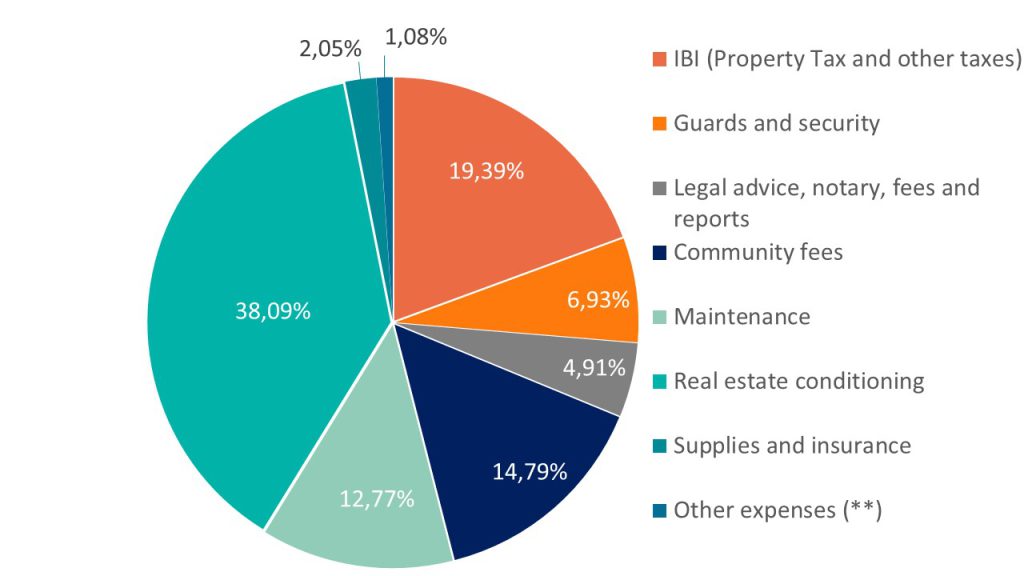

Sareb’s expenses