Sareb approves its accounts and presents its 2022 Annual Report

Sareb has officially closed its year of transition towards a new governance model that also saw the launch of its social strategy / Continues to repay loans underwritten by the State: 5,000 € million over three years / Almost 6,000 people are already benefitting from new social housing provision as Sareb seeks to balance social and financial sustainability

On Wednesday 28 June, SAREB’s Board of Directors gave the seal of approval to its 2022 Annual Report. Meanwhile, the company’s annual accounts were signed off by the General Shareholders’ Meeting.

It was a year marked by the approval of Royal Legislative Decree 1 of 18 January 2022, which cleared the way for the FROB (Fund for Orderly Bank Restructuring) to become SAREB’s majority shareholder as of April 2022, with a 50.14% stake. In light of this change, SAREB took steps to reshape its leadership and governance structures, reducing the number of directors from 15 to 9, and introduced a cap on remuneration for senior managers in line with current regulations. The company is also now subject to Spain’s Public Sector Procurement Law. In parallel, SAREB introduced its overarching Sustainability and Social Benefit principle, opening up new spheres of activity in relation to social and affordable housing.

Changes to SAREB’s servicer network, part of its Simplified Operational Model project (SMO), were another major milestone for 2022. As a result, Hipoges and Anticipa-Aliseda were awarded contracts for the management of loans and properties within its Divestment Portfolio. New servicers have also come on board, including Servihabitat, contracted in 2022 to provide specialist management services for housing used by vulnerable families.

Despite the significant challenge presented by these corporate and operational transitions, SAREB succeeded in growing its income by 8% in 2022, reaching €2,412 million, and repaying a total of €3,184 million in government-backed debt. Its outstanding debt has been pared down by approximately €5,000 million over the last three years. This means that, in the ten years since its creation, SAREB has reduced its total debt by €20,301 million, 40% of the original total, and divested 48% of its asset portfolio — from an initial value of €50,781 million to €26,465 at 31 December 2022. Property assets make up 59% of its current portfolio, the remainder being comprised of developer loans secured with real estate.

There was very significant growth in sales of assets developed by Árqura Homes, which generated revenue of €214 million – climbing 56% compared with 2021.

Over the course of 2022, SAREB conducted an exhaustive review of its entire portfolio in line with the applicable accounting standards, with the aim of reconciling each asset’s book value with its real market value. This was particularly relevant to land holdings, which have been hit with a significant drop in value. As a result of this review, the portfolio’s original book value was adjusted downwards by €11,626 million.

This is mainly attributable to rising financing costs (driven by higher interest rates over the last financial year), a general decline in valuation estimates and more cautious price projections for the real estate market. It should also be noted that SAREB’s new social management approach for certain assets in its portfolio prevented a further loss in value of at least €350 million.

Engagement in social housing

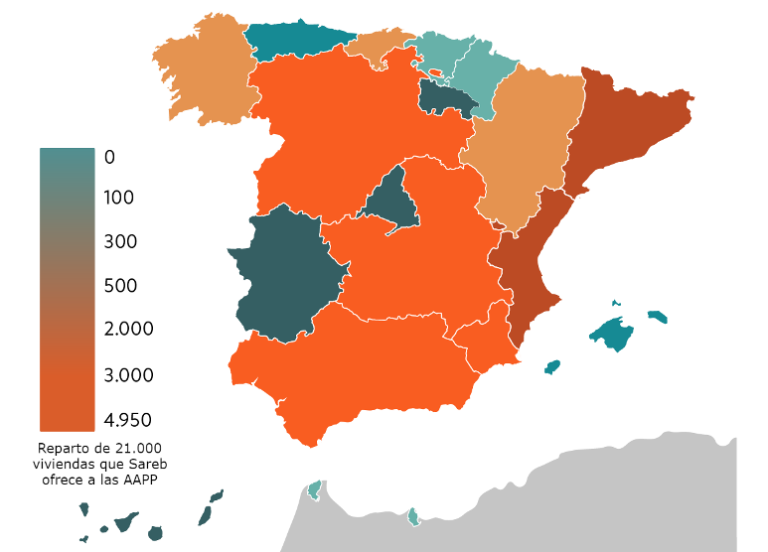

In pursuing its divestment strategy, SAREB has a duty to uphold the principles of sustainability and social impact. This dual mandate allowed it to deepen its involvement in various social housing initiatives over the course of 2022, including its partnerships with local authorities. As part of this collaboration, SAREB offered its housing stock to autonomous regions for use by social tenants, launching a targeted social renting programme with socio-occupational support; devised a project to transfer land to private investors for the development and management of affordable rental housing; and created an Advisory Committee comprised of specialists in this area.

The new management model for properties used by vulnerable families has allowed SAREB to unite a financially sustainable portfolio with a clear social impact. Towards the end of 2022, three months after the launch of the model, 1,938 homes were rented to social tenants. This indicates that approximately 6,000 people are already benefitting from the initiative, which requires participants to commit to take part in a Social Support Programme and Employability Plan.

The success of these initiatives clearly demonstrates the positive synergy between financial and social sustainability and contributes to SAREB’s primary purpose of repaying its government-backed debt.