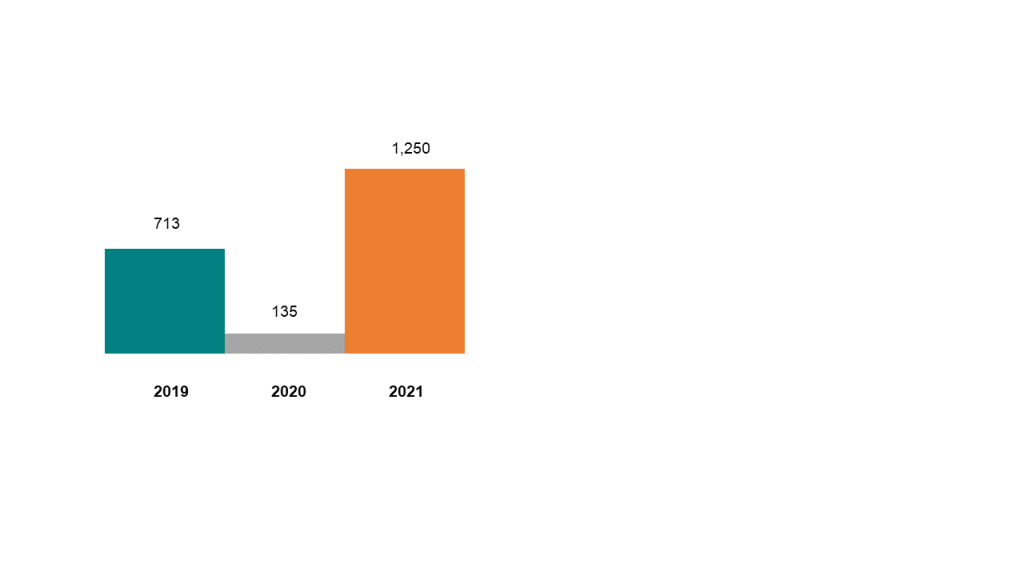

Sareb repays €1,250 million of debt in 2021 on the back of a revenue increase of 55%

Sareb has repaid more than €1,250 million of State-guaranteed debt against cash generated in 2021, taking its current debt burden to €33,664 million. In the nine years since it was first created, Sareb has reduced the State guarantee by €17,100 million, or 34% of the total.

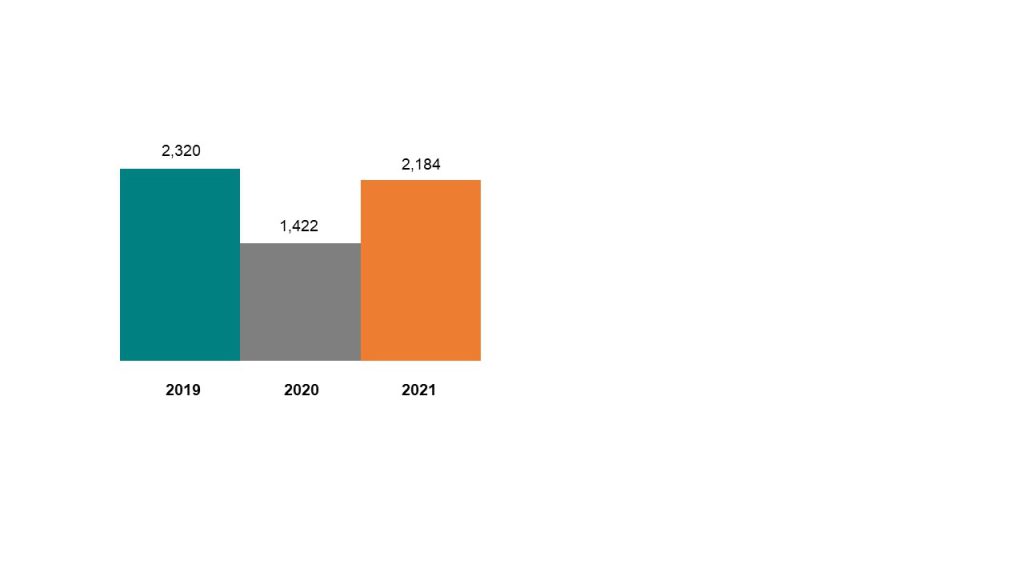

In 2021, the company’s repayment exceeded pre-pandemic levels (€713 million in 2019), after registering revenues of €2,184 million, 54% more than in 2020 and close to the 2019 figure. This means that Sareb has met its revenue and margin targets for the financial year.

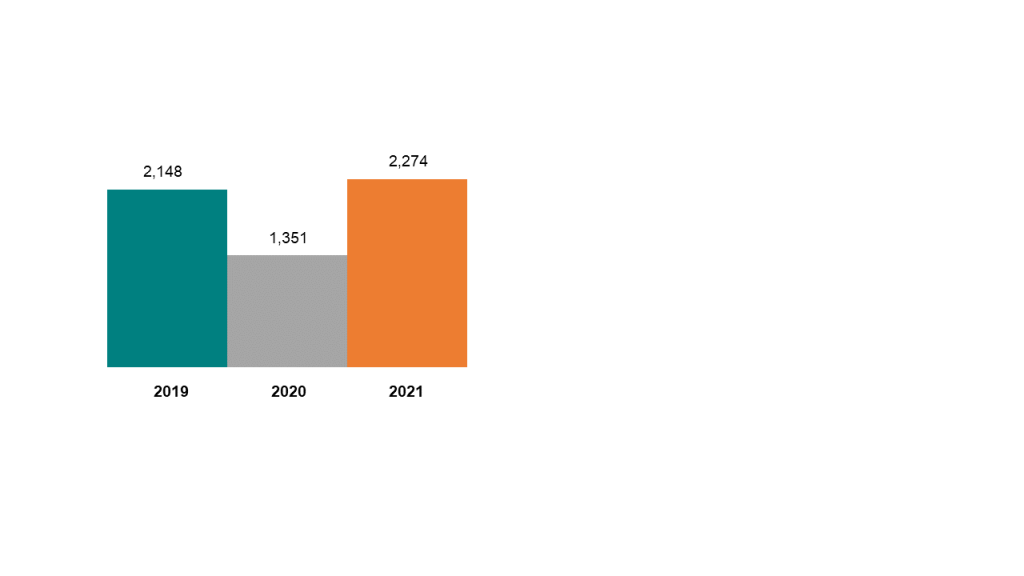

Meanwhile, recurrent revenues amounted to €2,274 million, above the 2019 level. Sareb’s target of disposing of assets that reflected the composition of its own portfolio – two-thirds of which carries unrealised losses – was key to driving the company’s revenues back up.

In 2021, Sareb’s sales profile reflected the company’s concerted effort to boost activities that optimised debt repayment. The company thus tried to avoid disposing of an excessive amount of higher-quality assets, prioritising both the sale of its least liquid assets and non-institutional property sales, as well as engaging in activities designed to increase the value of the portfolio, such as real estate development, completing unfinished works and land planning management.

Commercial strength and its impact on margins and results

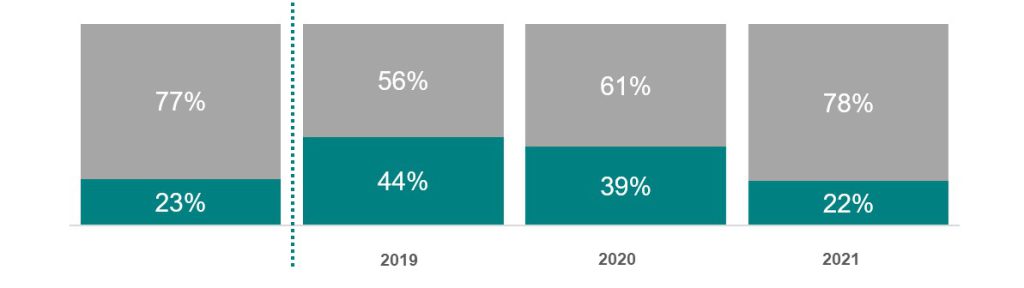

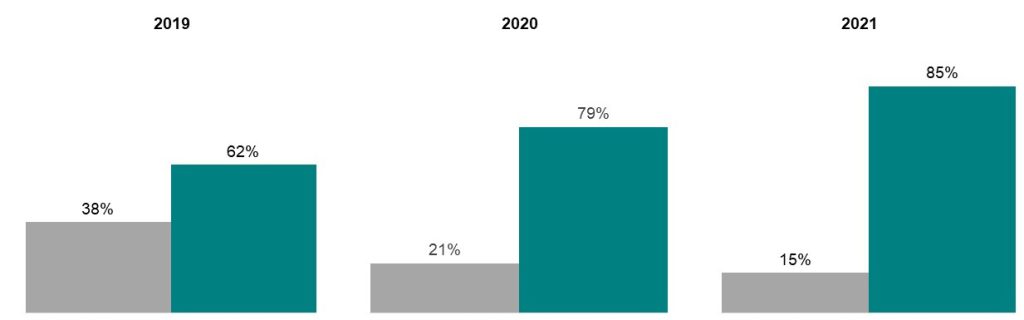

A total of €1,499 million of 2021 revenues came from real estate management and sales, an improvement of 77% vs. 2020. Lending generated €657 million, 16% more than in 2020 but below the 2019 figure due to the reduction in this element of the portfolio and the transformation of financial assets into property. Non-institutional sales (both individuals and companies) accounted for 85% of total sales, making 2021 the year in which Sareb had the least recourse to institutional transactions. The remaining €28 million was classified as Other Revenues.

A highlight of 2021 was the gradual recovery seen in the residential segment: sales reached €1,031 million, 61% more than in the previous year.

Growth was even stronger in the case of land and commercial property, which contributed €386 million, or 142% more than in 2020 and +58% vs. 2919.

In 2021, Sareb sold a record 23,263 real estate assets (residential, land and commercial properties). Of these, 19,226 were owned assets, of which 4,037 were buildings pledged against developer loans.

In parallel to this growing commercial activity, the company’s operating expenses increased by 14% to €688 million. This uptick was due to higher marketing costs – reflecting the increase in sales – and the cost of refurbishing the properties (due to the poor condition in which many of the foreclosed assets transferred as a result of real estate development/construction defaults were received) before they could be sold to non-institutional clients.

Also of note were overhead costs, which fell 7.5% in 2021, thanks to the efficiency plan that Sareb set in motion in 2020. The company has reduced the size of its management committee by 33%, and the number of directors by 16%.

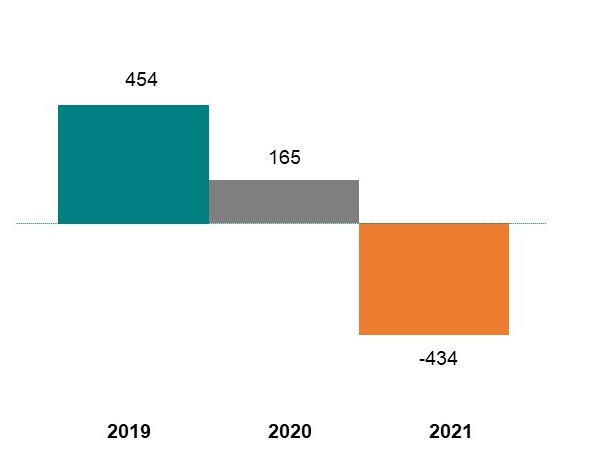

This asset sale strategy allowed the company to book a negative gross operating margin of €434 million (the difference between the sale price and the price at which the assets were transferred in 2012), in line with its targets for the year. This negative gross margin amounted to 19.8% of revenues. In 2022, the company will have to continue to push through sales of the least liquid assets on its balance sheet, where unrealised accounting losses account for 38% of the current value of its portfolio.

Net losses reached €1,626 million vs. €1,073 million the previous year. These losses have no bearing on the company’s viability, given that since 2020 Sareb has been under no obligation to have positive own funds to operate normally.

At the close of 2021, Sareb’s portfolio of assets registered accounting losses of €8,627 million, 5% less than the previous year, thanks to asset disposals.

Asset portfolio disposals

Disposals in 2021 reduced the portfolio by €2,615 million. It is worth noting that the 21% drop in developer loan defaults is the sharpest annual decline in the history of Sareb.

Since it was first created, Sareb has reduced its total asset portfolio by more than 43%, to €28,895 million. At present, slightly more than 50% comprises buildings, and the rest developer loans with real estate guarantees.

Renewed commitment to social housing

In 2021, the company signed a protocol with the Ministries of Economic Affairs & Digital Transformation and Transport, Mobility & Urban Agenda to increase its portfolio of social housing to 15,000 units.

Since it was created in 2012, Sareb has signed temporary agreements to make affordable housing available for rent. To date, it has signed such agreements for more than 3,200 properties with more than 50 autonomous regions and local administrations. It has also sold circa 350 properties to public authorities interested in initiating or augmenting their portfolios of social housing. To find housing solutions for vulnerable families in circumstances where signing a collaboration agreement with a public authority or local administration was not possible, Sareb has also signed 1,115 social rental contracts for such tenants.

Sareb’s commitment in terms of housing has been endorsed recently by the approval of Royal Decree-Law 1/2022. This change in the law does not alter the social objective but introduces a principle of sustainability that will allow the company to champion social housing solutions that offer the best technical standards in this regard.

Appendix

Total revenues* (€ million)

*Not including accrual of additional interest income (DIA) and other revenues

Total revenues* (€ million)

*Including accrual of additional interest income (DIA) and other revenues

State guaranteed debt repaid (€ million)

Breakdown of sales to non-institutional end-clients vs. sales to institutional clients (as % of sales revenues)

Gross margin (€ million)

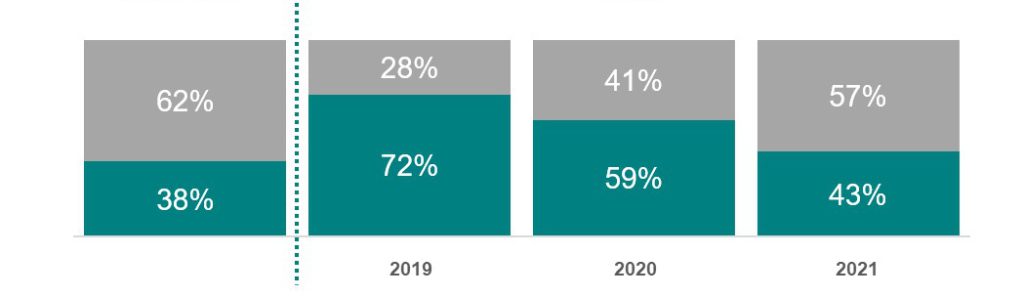

Breakdown of portfolio and sales (%)

Breakdown of current property portfolio and annual sales

Breakdown of current loan portfolio and annual sales