Sareb manages, with social commitment, the real estate assets stemming from the restructuring of the Spanish financial sector

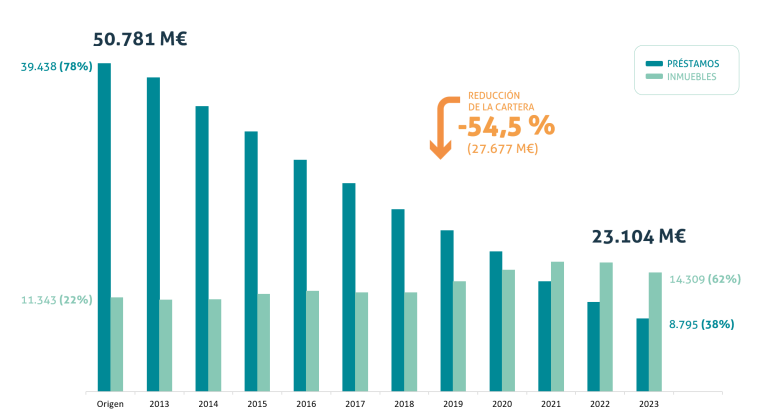

Sareb was created in 2012 to manage and liquidate impaired assets (loans and real estate) from financial institutions that required public aid. The company works on a day-to-day basis to liquidate this portfolio, as well as the associated debt guaranteed by the Spanish State. In 2022, Sareb’s divestment mandate was enriched with the incorporation of the principle of sustainability and social utility in the management of its assets.

This commitment was reinforced in 2025 through the transfer of its residential assets

to the Spanish state-owned housing entity, CASA47.

Our work

Property finder

News

Key figures

Sareb has repaid 42.1% of the debt it acquired at its inception and has reduced its asset portfolio by more than 57%.

The company works to fulfil its divestment mandate under the principle of sustainability and social utility, which include the provision of residential land and housing to CASA47.

Annual report Annual report

Annual report